SHARE

The Benefits of Stripe over PayPal

Contents

Contents

If you are an online business owner, then you have undoubtedly heard of both PayPal and Stripe as potential online payment processors for your business. But which one should you choose? In this blog post, we will explore the benefits of using Stripe over PayPal. Keep reading to learn more!

What is Stripe?

Stripe is an online payment processor that allows businesses and individuals to accept payments over the internet. Stripe is one of the most popular payment processors in the world and is used by millions of businesses of all sizes. It offers a simple, easy-to-use interface that makes it easy to accept payments.

It also offers a range of features that make it easy to manage your finances, such as automatically converting currency and issuing refunds. In addition, it is one of the most secure payment processors, with industry-leading fraud protection measures. As a result, Stripe is a popular choice for businesses that need to take payments online.

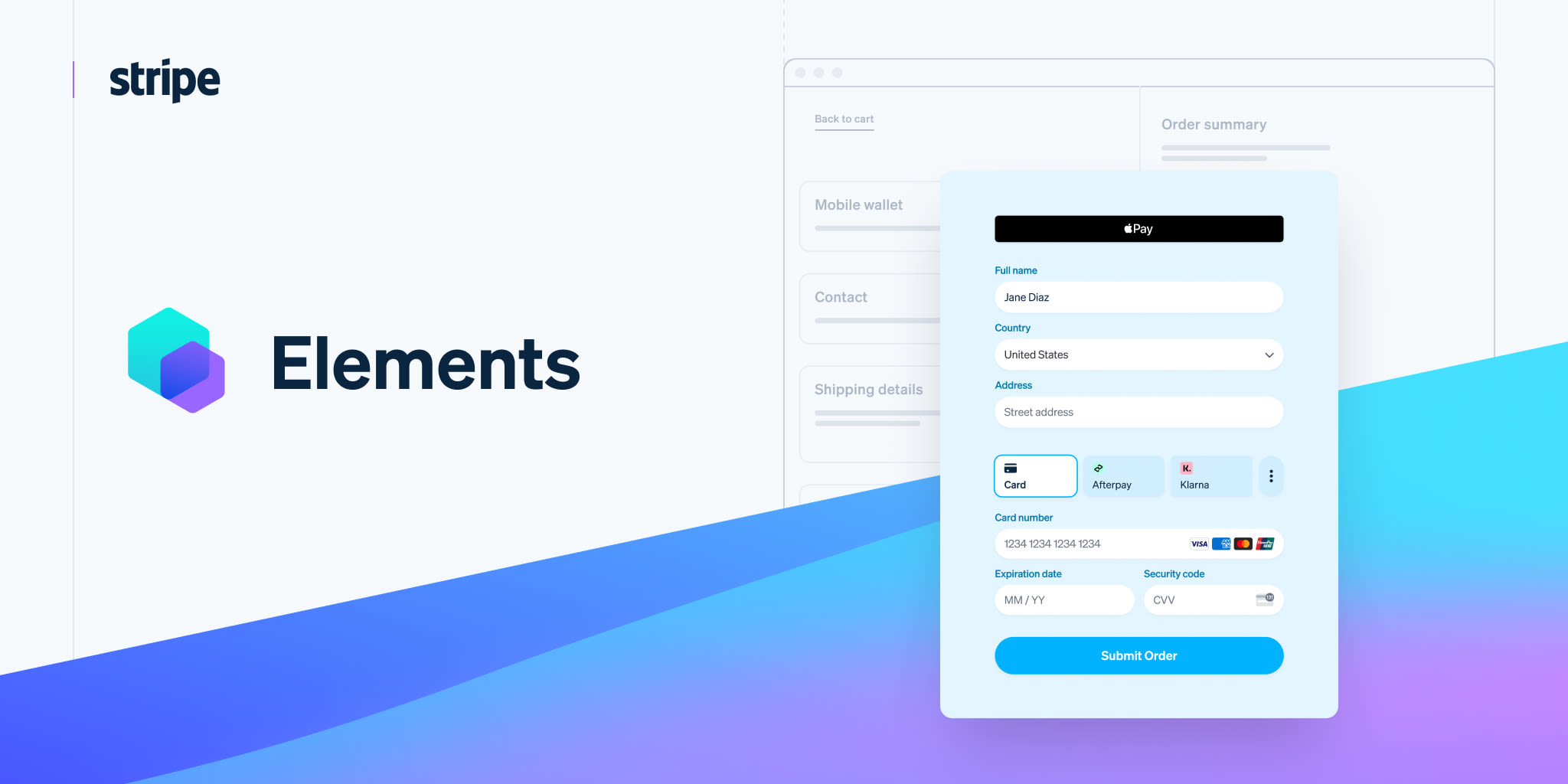

What makes Stripe a compelling offering for many businesses is its ability to handle almost any payment situation. Whether you are trying to handle subscriptions, coupons, donations, one-time payments, bank payouts, or almost any other payment processing situation, Stripe likely has developer-friendly documentation and API endpoints to support your use case. On top of that, Stripe offers pre-built UIs for no-code integrations, as well as flexible custom integrations that allow you to maintain your own styling. All of these features together make Stripe an attractive online payment processor.

How is Stripe different from PayPal?

For starters, PayPal offers a bit more versatility than Stripe. In addition to processing payments, it also offers features like invoicing and fraud protection. Stripe, on the other hand, focuses primarily on processing payments. It doesn’t offer as many bells and whistles as PayPal, but it makes up for it with lower transaction fees and simpler integration.

Stripe also has an edge when it comes to customer support. PayPal’s customer service is notoriously slow and unhelpful, whereas Stripe’s team is known for being responsive and knowledgeable. Ultimately, the choice between PayPal and Stripe comes down to personal preference.

Simply put, while both Stripe and PayPal are very large and popular online payment gateways, they have a bit of a different focus in terms of what they attempt to be good at.

15 Benefits of Stripe over PayPal

Online payment processing is the backbone of e-commerce and SaaS, and it’s essential to have a reliable and efficient payment processor. Two of the most popular services are Stripe and PayPal. Both platforms do an excellent job of enabling you to process payments, but there are some distinct differences between them. Here are 15 of the top benefits that Stripe offers over PayPal:

1. Easy Integration

Stripe makes it easy to integrate its services into any website. It has comprehensive documentation, so you can get up and running quickly. The company also provides libraries and APIs to help make integration painless. Stripe even offers a no-code UI solution (see below) that can be integrated into your website. It doesn’t get much easier than that.

2. Flexible Payment Models

Stripe offers flexible payment models for businesses. If you are an e-commerce website, you can use Stripe for one-time checkouts. If you are a subscription business, you can use Stripe for recurring billing. Assuming you are a two-sided marketplace, you can use Stripe to facilitate transactions between buyers and sellers on your platform. On top of all of these payment models, you have extra functionality like discounts, refunds, identity verification, and so on. This capacity to handle different payment options is definitely a plus for Stripe.

3. Robust API and Documentation

A common advantage that Stripe has over many payment processors is its developer-friendly and robust API. The Stripe API is very well-documented and if you know it well you can facilitate many different payment integrations. This means that Stripe is likely to scale with your business and handle your payment processing needs as they become more complex over time.

4. Security

Stripe has industry-leading security features that protect both customers and merchants from fraud and other threats. It uses tokenization to protect payment information, and also offers two-factor authentication for added protection. Stripe will allow you to provide advanced payment processing functionality to your system in a secure manner. For instance, if you want your users to add bank accounts that you can send money to, your users can securely enter their banking details and upload an identity verification document that Stripe will process for you. These are advanced security features for a payment processor.

5. Multi-Currency Support

Stripe supports multiple currencies, so you can accept payments from customers all over the world. This makes it easy to conduct business with international customers without having to worry about exchange rates. Stripe continues to push the boundaries on international transactions and international payments, and even has a service called Stripe Atlas which allows foreign founders to setup a U.S. entity and receive payments to a bank account in the United States.

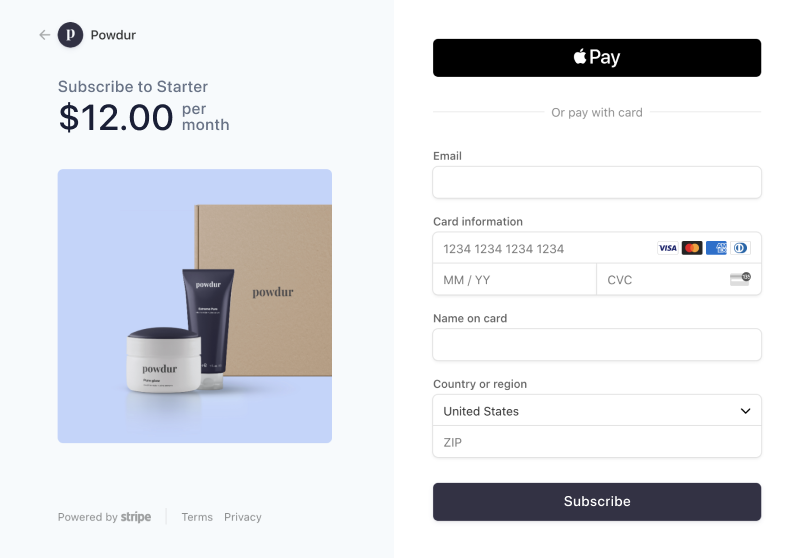

6. Recurring Payments

Stripe allows merchants to set up recurring payment plans for customers who want them. This is a great way to increase customer loyalty and generate more revenue. It also makes it easier to manage billing for customers. Subscriptions are a primary use case for Stripe, and it is one in which the flexibility of the Stripe API becomes very useful. For instance, beyond the standard monthly payments that any SaaS platform will have, Stripe will allow you to do more custom things like setup fees, coupon codes, subscription add-ons, and so on. The Stripe API makes for a powerful payment experience that you can mold to fit your business.

7. Ease of Use

Both Stripe and PayPal are very user-friendly, making it easy for customers to make payments quickly and securely. With no complicated setup process, you can get up and running with either in a matter of minutes. Stripe, however, also offers more flexibility in how it is used. They have no-code payment UIs that you can integrate into your application, or you can utilize your own code and their API to build out more sophisticated payment experiences. Stripe is better suited if you need a customizable checkout flow, and lets you integrate your shopping cart to fit your store’s brand and aesthetics. PayPal does not offer these customizations, and for this reason, is sometimes seen as the easier option to set up.

8. Automation

Stripe has powerful automation features that enable merchants to automate their payment processing. This helps to streamline transactions and ensure that payments are processed quickly and efficiently. The Stripe API is likely the simplest to use and most powerful online payment processing API. This allows for higher levels of automation and less manual intervention when utilized correctly.

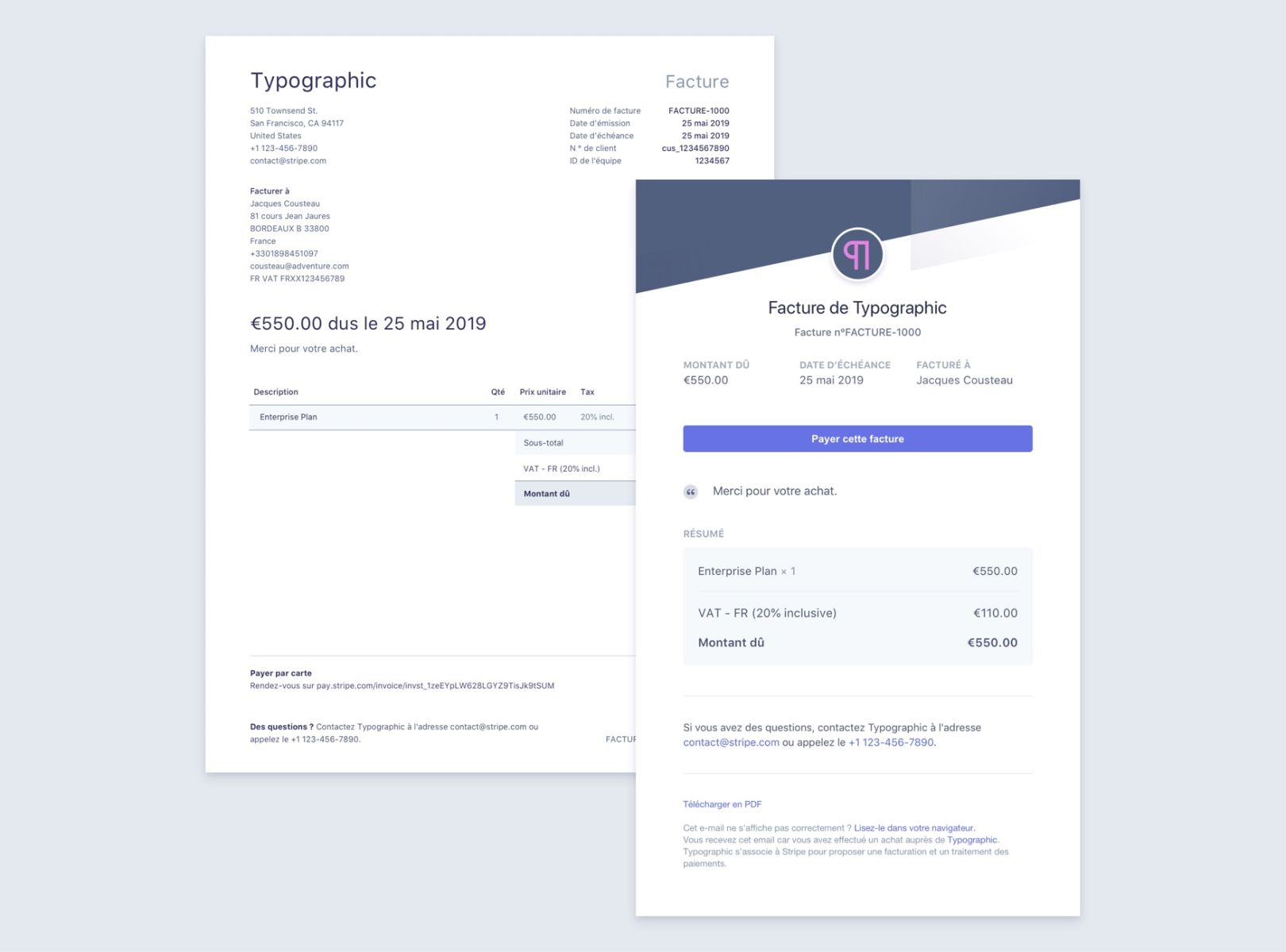

9. Invoices

Stripe allows merchants to easily generate invoices for customers, so they can keep track of payments received or refunds issued. This is especially useful for businesses with high transaction volumes who need to stay organized.

10. Customer Support

Stripe offers 24/7 customer support, so you can get help when you need it. The company also has an extensive documentation library and helpful tutorials to help you get started. They also offer online chat and email support for customers.

11. Integrations

Stripe integrates with a wide range of services, including accounting software, marketing platforms, and customer relationship management (CRM) systems. This makes it easy to link up different services and increases efficiency.

Because Stripe is a developer-friendly platform with a robust API, there are always new ways of integrating with Stripe.

12. Global Reach

Stripe is available in over 130 countries, so you can easily accept customer payments worldwide. It also supports multiple languages, making it easier for customers to use.

Additionally, Stripe has engaged the international community to increase online payment accessibility worldwide. In countries where online credit card processing is not as friendly as in the United States, Stripe even offers Stripe Atlas, which allows foreign businesses to start a U.S. entity and accept payments through Stripe in the U.S.

13. Payment Scheduling

Stripe allows you to schedule payments in advance and automate payment processing. This helps to ensure that payments are processed on time and also reduces the amount of manual work required by staff. If you don’t want to charge a user now but want a payment to be processed further down the road, the Stripe API will let you kick the charge to date down the road.

14. Refunds

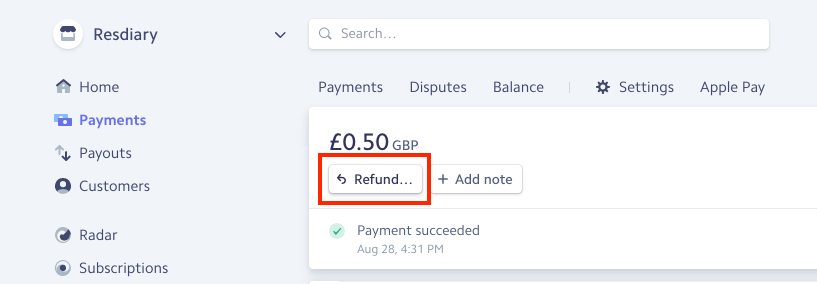

Stripe makes it easy to issue refunds to customers quickly and efficiently. This helps to ensure customer satisfaction and build trust in your business. It also helps you to avoid any potential disputes.

In addition to standard refunds of charges that were paid to your own Stripe account, Stripe allows for more complex refund scenarios. For example, let’s say you are a two-sided marketplace that facilitates transactions between buyers and sellers. In this situation, you can actually open an invisible Stripe account for your sellers and allow buyers to pay sellers’ Stripe accounts. However, you also need fine-grained control for such a business model, in case a buyer disputes their purchase. In this situation, you can refund a payment that was made to the seller’s Stripe account. And, if you don’t need automated refunds, you can always use the Stripe Dashboard to process a refund.

As you can see, the ways that you can utilize Stripe payments and refunds are relatively robust.

15. Scalability

Stripe is designed for businesses of all sizes, so you can scale up or down as needed. This makes it a great option for businesses looking to grow quickly. It also allows businesses to do more with less, so you don’t have to worry about outgrowing your payment processor.

Additionally, when you utilize Stripe, you can rest assured that if your business grows to support new business models or payment models, you will likely find a Stripe API to support your needs.

What are some of the drawbacks of using PayPal?

Although PayPal is a very popular online payment gateway, it does have a few drawbacks. One of the biggest concerns is security. One of the fears that certain merchants deal with when they utilize PayPal is uncertainty around payout times and uncertainty in account stability. PayPal has been known to freeze accounts without notice or explanation, which can be disruptive for businesses that rely on the service.

Another downside of PayPal is that it can be costly to use. The company charges fees for many types of transactions, and these fees can add up quickly. If you look at their list of transaction fees, chargeback fees, and service fees, it can be very difficult to decipher what you will pay for everything. For these reasons, some businesses and individuals have decided to look for alternative online payment processors.

Stripe vs. PayPal: Which Online Payment Processor Is Best?

PayPal used to be owned by eBay, and it is a popular payment processor for online merchants. PayPal can offer lower transaction fees than Stripe, but it is less likely to be quite as robust as Stripe in terms of the complexities it can handle with online payment processing.

Stripe has also been around for a while and has many different financial services online. In fact, Stripe Treasury is a Banking-as-a-Service API that allows you to create financial services directly within your platform.

For the majority of U.S. businesses, Stripe will be a great option. If you are at scale and need to compare the transaction fees of Stripe vs. PayPal, then PayPal might be worth another look. However, the flexibility of Stripe and its ability to securely handle all sorts of payment transactions certainly make it an attractive option for most.

Custom Payment Integrations with Flatirons

PayPal is an excellent payment processor, but there are several reasons why Stripe might be a better choice for your business. We’ve looked at the benefits of Stripe over PayPal, so hopefully, you have a little more information to help make your decision. Flatirons is an expert in online payment gateways and can build any custom payment solution you need.

Fintech Software Development Services

Flatirons Development delivers cutting-edge fintech solutions, driving innovation in financial technology.

Get the CEO's Take

Handpicked tech insights and trends from our CEO.

Fintech Software Development Services

Flatirons Development delivers cutting-edge fintech solutions, driving innovation in financial technology.

Get the CEO's Take

Handpicked tech insights and trends from our CEO.

Enterprise Computing: Transforming Business Operations

Flatirons Development

Oct 09, 2025

Best Data Analytics Strategy for Business Growth

Flatirons Development

Aug 25, 2025

Team Lead vs Manager: Understanding the Key Differences

Flatirons Development

Aug 07, 2025

Exploring the Crucial Stages of a Startup Journey

Flatirons Development

Jul 16, 2025

Business Intelligence Benefits: Unlock Data-Driven Growth

Flatirons Development

Jul 08, 2025

Cloud Computing Strategy: Unlock Business Growth Potential

Flatirons Development

Jul 07, 2025